Client Letters: Amazon Earnings, Credit Card Spending and PRIME

Another quarter in the books with Amazon announcing their Q1 2024 earnings this evening. A few takeaways along with some credit card spend data and a look to Amazon Prime:

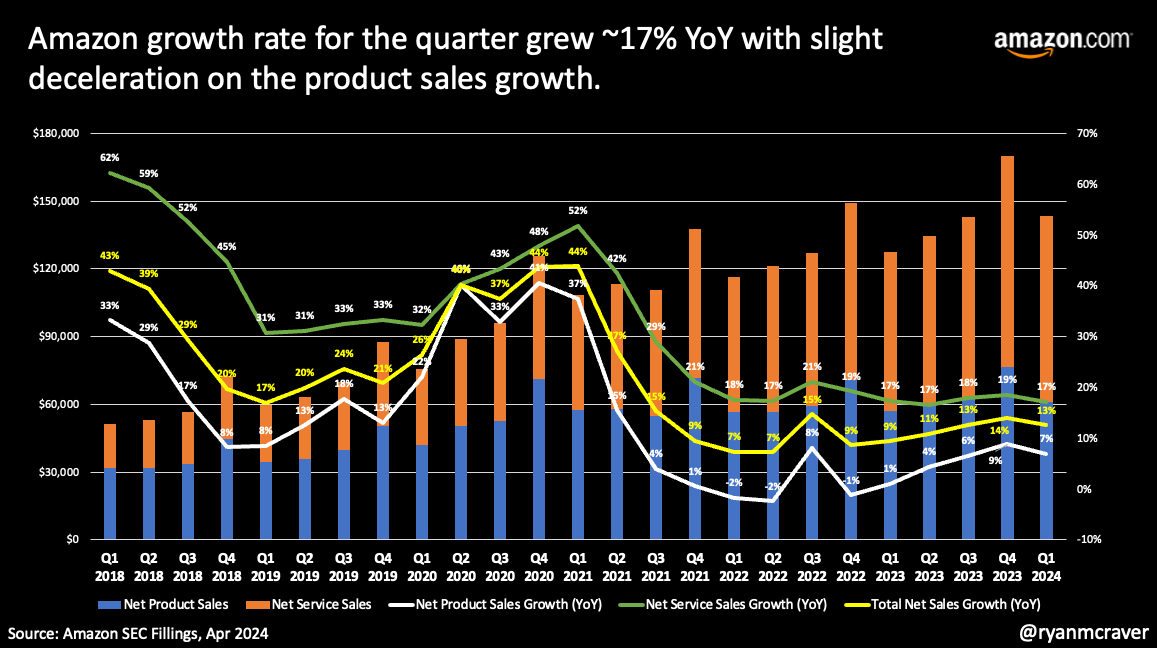

1. Product sales slow, SERVICES SERVICES SERVICES - Product sales grew 7% versus service sales growing 17% and now accounting for nearly 58% (vs. 55% in Q1 2023) of total net sales.

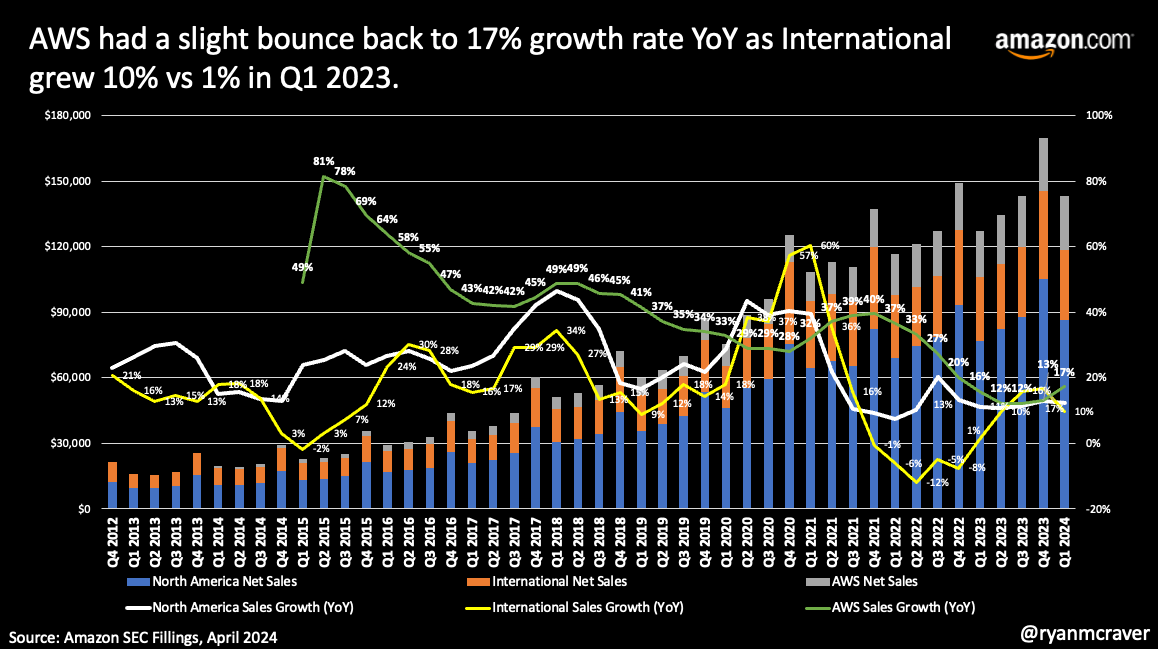

2. International back to growth - US remained flat with last year’s growth rate but International is back with several consecutive of quarters of positive growth. Interestingly, AWS now nearly half the size of Online Stores, the business was only a 1/4 the size 3 short years ago.

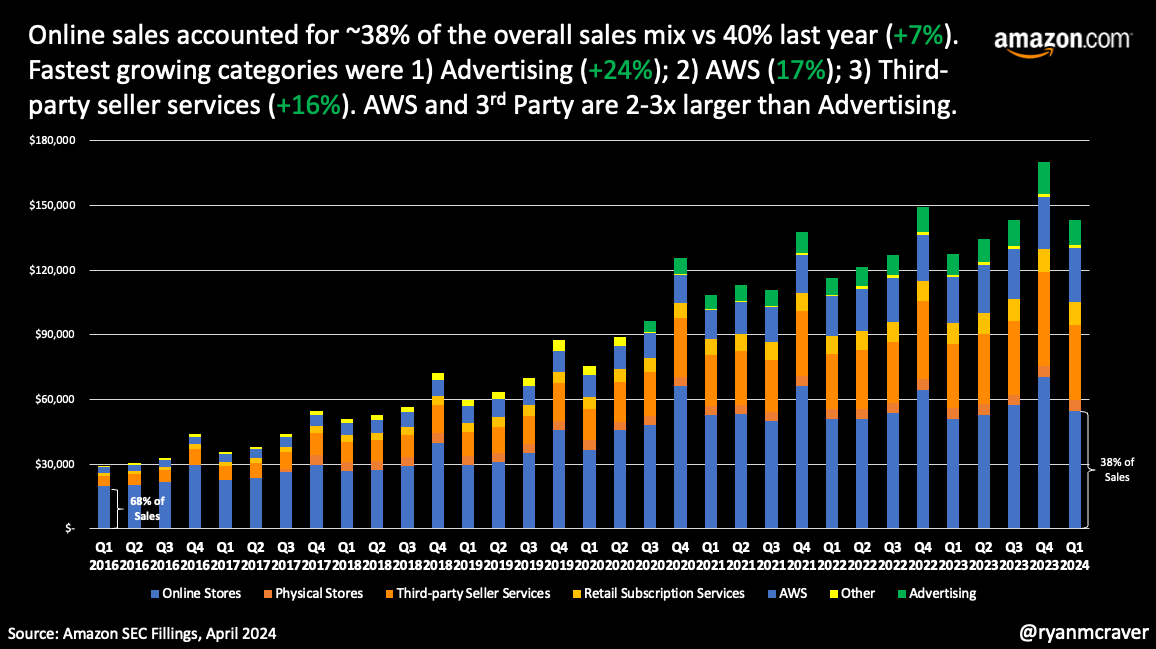

3. Amazon reliant on 3rd party sellers and advertising - Continued strong growth from both 3rd party seller services (aka Seller Central) and advertising. Those two businesses now account for 33% of total sales vs 26% a few short years ago. Recent fee changes likely will mainly be seen in the next quarterly earnings report.

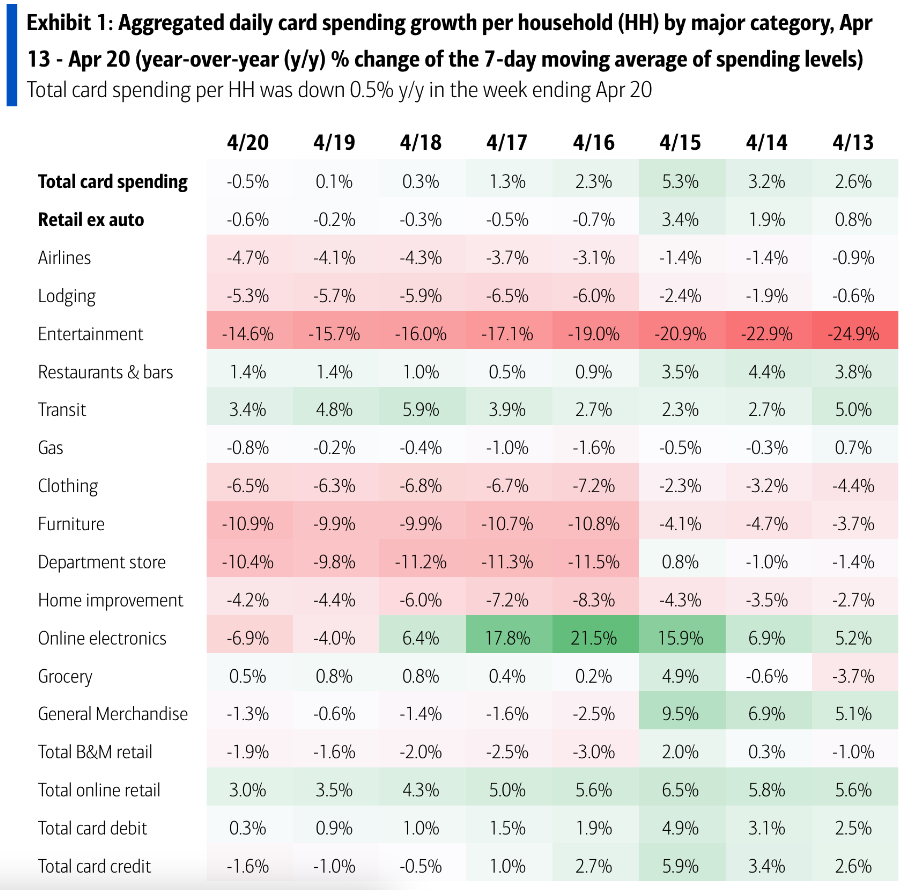

None of these trends are new to you as readers of these letters. Amazon continues to become the “toll booth” of eCommerce and now own nearly 40% of eCommerce. Recent credit card spending data from Bank of America illustrates weakness in all categories but Restaurants & Bars and Transit as Andy Jassy gave us his blunt statements of “discretionary is difficult” and “customers are trading down on average selling price.”

With the above trends, we continue to reiterate the need for brands to be: 1) hybrid using 1P and 3P models for all retailers; 2) multi-channel marketers not reliant on just Amazon advertising; 3) thrive on the strength of the brand for consumers already “bought into” your brand, extend the audience to those not aware of your brand. Whilst we don’t believe Amazon Prime will live up to “hoped for” expectations, we do believe the event continues to be the dominant Q3 event. This year is no exception but brand roles vary:

If you are dominant in a particular category, play defense by increasing your keyword bids on branded and non-branded terms whilst holding retail.

If you are still heavy on fall stock, unhealthy inventory or obsolete stock, use Prime Day deals. The markdown will offset the cost of holding or returning.

If you have dogs that aren’t yet winners, experiment with markdowns. Prime is the time to test a larger, more energetic audience.

Please reach out to your Brand Manager with any questions, we are here to provide you a recommendation based on experience, data, understanding of your brand mixed with legitimacy.

Thank you,

Ryan